what tax rate to charge for online sales

So you get that as an eCommerce store owner, you lot demand to be sales tax compliant. This means that in the U.s. specifically, you lot have to charge sales taxation to buyers in states where you have nexus. All states accept a slightly different definition of nexus, simply most of the time states consider that a "physical presence" or "economic connection", based on sales into that country, creates nexus.

Even later on yous accept done the research to understand where you have nexus, and then how much do you charge? Does it vary from customer to customer? And why does this have to be so complicated?

And more importantly, is at that place a solution that tin automate everything and so WooCommerce customers don't have to deal with whatsoever of this? The skillful news is, yeah there is!

First, nosotros'll explain a bit most how sales taxation works, and then we'll show you how you tin can utilise TaxJar to automate the entire process so yous never have to stress well-nigh sales tax again.

While determining the right rates to accuse can exist tricky, a piddling reading volition assistance you wrap your head around it in no time. Today, nosotros'll explain the unlike sales tax rates in the United States, and help you effigy out which rates to accuse your customers.

If you're a growing eCommerce business organization with multiple sales channels (WooCommerce, Amazon, Walmart, etc.), and want to have advantage of fully automatic sales taxation and filing services, nosotros recommend yous cull TaxJar .

Let's get started.

Determining the right tax rate to accuse is tricky

45 states and Washington D.C. all have a sales tax. It's remitted back to states and local areas to pay for things like public safety, roads, and other land budget expenses. Sales tax is governed at the individual state level, and then taxation rules and regulations are slightly different from land to country .

A handful of states are fairly simple. They have one statewide sales tax rate, which generally ranges from 4-7% — meaning you lot only need to charge that single rate when you have nexus.

Instance: You're a seller of sci-fi memorabilia living in Connecticut. Since you live there, you lot take sales tax nexus in that land. Since Connecticut but has a statewide sales tax rate and no local rates, your life is uncomplicated: in most cases yous will just charge the 6.35% statewide sales tax rate on all sales.

Setting up taxes for these states isn't too catchy. But in that location's a catch. (Prototype credit: Ali Edwards)

Merely… near states make life a lot more than complicated. They non just have a single statewide rate, but also let local areas to tack on additional taxation rates . It's for this reason that you may end up charging your customers some combination of a country, county, metropolis, and "special taxing district" taxes when making a sale.

Case: You sell skincare products from your dwelling in Obetz, Ohio. Ohio is an origin-based sales taxation land (more on that in simply a second), and then your sales taxation charge per unit in Obetz is seven.five%. That's made up of the five.75% Ohio land sales tax rate and the 1.25% Franklin County rate.

As you might accept guessed, this can get even more complicated if you sell or have nexus in an expanse that has sales tax, county tax, and city tax.

The "monkey wrench" for online sellers: origin and destination-based sales tax

Then there'southward another wrench to throw into the equation.

When it comes to aircraft products, some states are origin-based sales taxation states and some are destination-based sales taxation states. This can as well affect whether or not you charge revenue enhancement, and how much you charge.

Permit's go over this in a little more item.

Origin-based sales tax

Origin-based sales tax is adequately simple. If y'all have home-state nexus in a state (i.due east. your company is based there) and you lot sell a product to a buyer in that state, you pay sales taxation at the sale'southward point of origin (i.due east. your location) .

The states that employ origin-based sales tax rules are:

- Arizona

- California*

- Illinois

- Mississippi

- Missouri

- New United mexican states

- Ohio

- Pennsylvania

- Tennessee

- Texas

- Utah

- Virginia

* In California, state, canton, and city taxes are based on the origin, simply commune taxes are based on the customer'southward location. This is the merely country with this rule.

If yous live in one of these states and sell to a customer in the same state, you only take to charge sales tax at the rate of your location. (You can look up your local sales revenue enhancement rate past entering your zip code + 4 in TaxJar's Sales Tax Calculator .)

Example: You lot live in Irving, TX but make a auction to a heir-apparent in Archer City, TX. Even though yous've made a sale to a person in an entirely different taxing jurisdiction, you would still charge them the combined Irving sales tax rate of 8.25%. This rate is made upwardly of the 6.25% Texas country rate, plus the ane% Irving sales tax rate and the Dallas Metropolitan Transit Authority (MTA) rate of 1%.

An example of origin-based sales tax rules in effect.

Destination-based sales tax

Destination-based sales tax states are more complicated, and also more common. In these states, you accuse sales tax based on the rate at your client's location (that is, their "ship to" address). This besides most oftentimes the case for remote sellers in usa when you accept nexus. More than on this later.

Example: You operate your concern out your warehouse in Stamford, NY, and sell an item to someone in Buffalo, NY. Since New York is a destination-based sales tax state, you would charge sales revenue enhancement to your heir-apparent based on their rate of 8.75%. That'due south the 4% New York country rate plus the 4.75% Erie County rate.

A destination-based state requires you to accuse the customer's tax rate, non your own.

As y'all can see, charging sales revenue enhancement is a little more than involved when yous're trying to accuse taxation to buyers in a destination-based state.

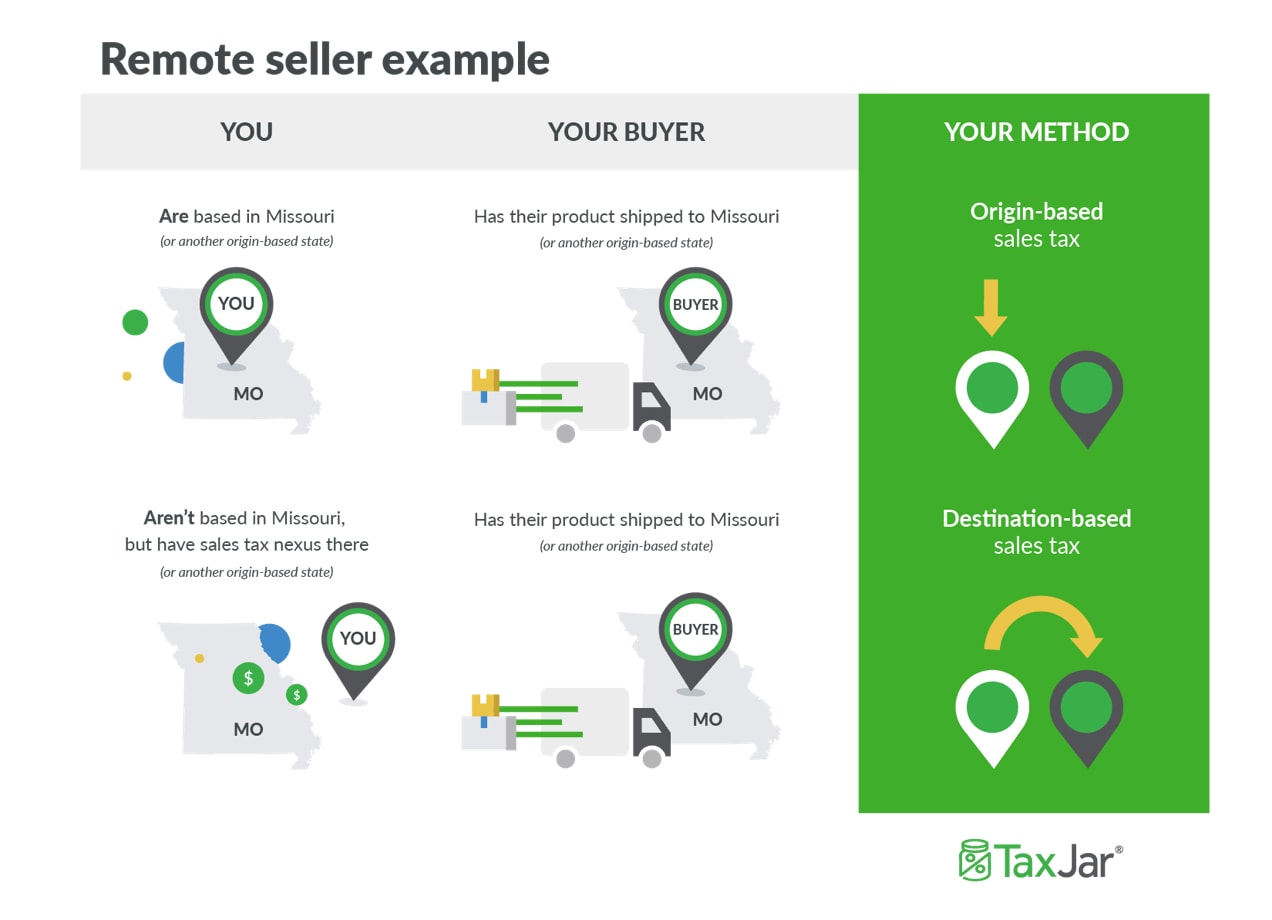

Collecting sales tax as a remote seller

One other of import consideration has to do with existence a remote seller. A "remote seller" in sales tax terms is considered someone who has sales tax nexus in a state, simply isn't based in that state . At present, not simply does physical presence (such equally a location, employee or inventory), but "economic" presence in a state creates sales revenue enhancement nexus. Economic nexus is created when a business organisation sells plenty into a certain state. Country laws on economical nexus vary. The sales thresholds vary from $10,000 to $500,000 in sales, and some states don't accept a transaction threshold at all. You can read more on economic nexus laws hither .

Most of the fourth dimension that this happens, destination-based revenue enhancement rules use.

Example: You live and operate your business in California merely take hired an employee in Missouri. This ways you now have sales tax nexus in both California and Missouri. Missouri is an origin-based sales taxation state for in-state sellers, only in this instance you are considered a "remote seller" since you are based in California.

Since you are a "remote seller," Missouri's origin-state sales tax rules don't apply to y'all . So if you were to make a sale to a buyer in Missouri, y'all would charge that buyer sales tax based at their local sales tax charge per unit — that is, using destination-based sales taxation rules.

To suspension information technology down:

- If you live in an origin-based sales revenue enhancement state , accuse sales tax to same-state customers at your local surface area's total combined sales tax rate.

- If you are considered a "remote seller" in an origin-based state , you lot'll probably exist required to charge sales at the total combined sales tax rate of your customer'due south location.

- If y'all are considered a "remote seller" in an destination-based state, and have nexus in that state, you'll probably be required to charge sales at the total combined sales taxation rate of your customer'southward location.

This isn't easy stuff to grasp on your offset try, and then check out this post for more than than you ever probably wanted to know about origin-based and destination-based sales tax.

When to charge sales tax on shipping

One other thing to consider is that many states also require sales tax to be charged on shipping and delivery costs .

Case: You have nexus in Rhode Island, a state that considers shipping taxable. If you sell a $10 item to a customer and charge them $2 for shipping, then you lot would charge the applicable sales tax charge per unit on the entire purchase .

On the other hand, some states, like Alabama, do not consider shipping role of the taxable transaction and therefore the shipping charges are not taxable. So if you ship the latest must-accept toy to a heir-apparent in Alabama for an item price of $19.99 plus $5.00 aircraft, you would only need to charge sales tax on the $19.99 particular cost .

These states say shipping charges are not taxable if you lot show the charge separately from the selling toll of the item. They are taxable if you include the charge as part of the cost of the item.

- Alabama

- Arizona

- California

- Idaho

- Iowa

- Louisiana

- Maine

- Maryland **

- Massachusetts

- Missouri

- Nevada

- Oklahoma

- Utah

- Virginia **

- Wyoming

** For these states, if shipping and handling fees are combined, shipping is taxable. However, if they are listed and charged separately, they are not.

If y'all have nexus in a state not listed above, you should be charging tax on your customers' entire purchases, including the shipping.

Charging the right rates shouldn't crusade headaches

This stuff starts to get circuitous fast. Fortunately, there's the WooCommerce Sales Tax Automation plugin from TaxJar . This plugin will ensure y'all accuse the right amount of sales tax to every customer, whether it's origin-based sales taxation, destination-based sales taxation or taxable aircraft.

TaxJar'due south WooCommerce sales taxation plugin is perfect for merchants who want to:

- Implement real-fourth dimension updates to their sales revenue enhancement rates at checkout

- Automate their sales taxation filing

- Get sales taxation data from multiple channels in an easy-to-read, return-ready state reports

TaxJar'due south solution tin can besides:

- Provide economic nexus insights, with recommended steps to begin complying with in any new country

- Handle and scale with any uptick in need increase, such as seasonality or special deals

- Allow for piece of cake direction of customer and product exemptions

What about assist with filing my sales tax returns with the state?

Every bit many sellers come up to find out, collecting the right amount of sales tax is just the beginning. One time your cart is setup, you'll then need to cull how to remit the sales tax you lot've collected back to the country.

To manage sales tax for your business, y'all have a few options:

- Handle it all yourself. Nosotros recommend making a agenda to track your due dates and when the fourth dimension comes to file, log in to the state's website(due south) and enter the information to consummate your return.

- Choose a recommended WooCommerce partner, TaxJar, that tin can fully automate everything for you.

- Hire a sales tax accountant to help you manage everything for you.

Here's how information technology works if you choose to lean TaxJar to manage your sales tax:

Want to acquire more near installing the WooCommerce sales tax plugin from TaxJar? Cheque out their installation guide .

TaxJar volition connect direct to your WooCommerce store (and anywhere else you sell like Amazon or another marketplace). Adjacent, they volition import your transaction data into a single sales taxation dashboard organized by the corporeality collected, and determine where y'all accept nexus. This is helpful to eCommerce merchants because yous're able to run into the full picture of your sales tax in every country at i glance.

At this bespeak, TaxJar will now exist able to instantly provide yous with accurate sales taxation rates at checkout. Never update a charge per unit tabular array again.

Once your dashboard is connected, you can then choose how you'd like to manage your filings. You accept a option to enroll in AutoFile where TaxJar will submit your returns to the state every time they are due, or handle them on your own.

Visit TaxJar to get a free demo or to learn more about how TaxJar helps WooCommerce merchants . If you're spending besides much time managing sales tax, lean on TaxJar and get back to growing the business you dear.

Want to become started now? Call 855-800-6681.

Source: https://woocommerce.com/posts/sales-tax-rate-guide/

0 Response to "what tax rate to charge for online sales"

Post a Comment